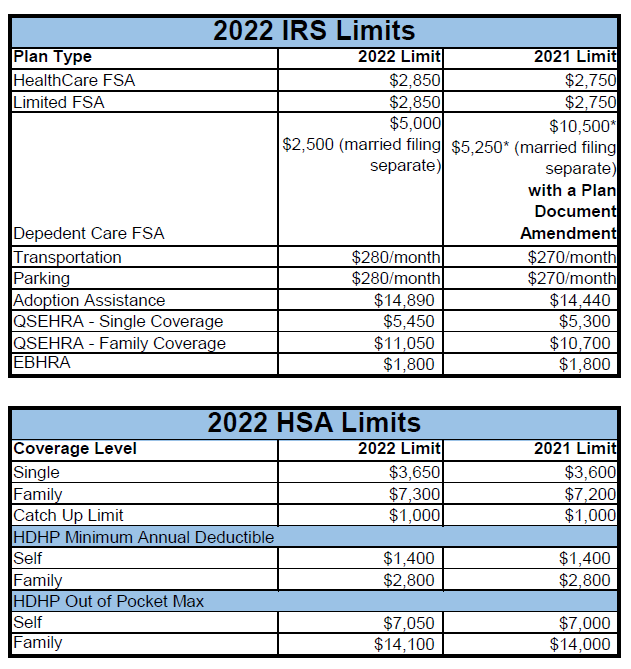

The IRS Released Revenue Procedure 2021-45 just now announcing the limits for 2022. Most limits for tax-advantaged accounts did increase for the upcoming year. The HSA Limits and HDHP Limits were announced earlier this year in Revenue Procedure 2021-25.

The new limits are detailed below. Please keep in mind that these limits go into effect for plan years beginning on or after January 1, 2022. If your plan does not operate on a calendar year, you will need to wait until your next plan renewal to make an increase.

For our calendar year clients, we know that this announcement is in the middle of many of your Open Enrollment timeframes. If you wish to make this increase, please reach out to our Enrollments Department by emailing us at enrollments@flex-admin.com.

Please note that making an increase could require that your Section 125 Plan Documents be updated. If that is the case, we will provide you with a quote for that additional service.

Recent Comments