Flexible healthcare solutions.

Flexible Benefit Administrators (FBA) has been changing the way clients manage their benefits programs for over 36 years. Our philosophy at FBA is to create services to fit our clients; not services our clients must fit.

Flexible Spending Accounts Health Savings Account Health Reimbursement Arrangement (HRA)

More than benefit plans,

FBA solutions include full-service administration, ongoing support and experience. Lots of experience.

Our plans are designed with flexibility so they can align with any benefit strategy. When partnering with FBA, not only will you receive a benefit plan but also full-service administration and on-going support.

With our name on the line we furnish excellence by implementing a business model that simplifies benefit processes yet allows each of our clients to offer a plan option to meet their employees’ unique needs. FBA places a premium on superior service.

FSA Solutions from FBA

What is an FSA?

An FSA is a Flexible Spending Account, allowing employees to set aside pre-tax dollars to be used for eligible expenses, which can save them money down the line by offsetting taxable income. Different FSA programs include a Healthcare FSA, Dependent Care FSA, Limited FSA, and Adoption Assistance Account.

HealthCare FSA

HealthCare FSAs can be used to pay for qualified healthcare expenses, including medical, dental, and vision costs, that are out of pocket expenses. By offering a HealthCare FSA, participants are able to pay for these qualified expenses incurred during the plan year as an active participant.

Limited Purpose FSA

A Limited Purpose FSA is exclusively designed to offset the cost of dental and vision expenses. This FSA program is available to employees who are enrolled in a high deductible health plan (HDHP) as well as an HSA. Limited Purpose FSAs offer additional tax savings for employees, which in return increases plan participation.

Dependent Care FSA

The Dependent Care FSA is used to pay for eligible dependent care expenses. A few qualified expenses include but are not limited to child care, elder care, nursery school and more. The maximum annual contribution limit for a Dependent care FSA is $5,000. This plan is a smart, simple way to save money while taking care of your loved ones.

HRA Solutions from FBA

What is an HRA?

An HRA is a Health Reimbursement Arrangement (sometimes called a Health Reimbursement Account), and is an IRS-approved, employer-funded, tax-advantaged health benefit used to reimburse employees for out-of-pocket medical expenses and personal health insurance premiums.

Types of HRAs

Standard HRA

Medical Expense Reimbursement Plan (MERP)

Individual Coverage HRA (ICHRA)

Qualified Small Employer HRA (QSEHRA)

Excepted Benefit HRA (EBHRA)

The EBHRA permits employers that offer a group health plan to provide an annual pre-tax limit, even if the employee does not enroll into the group health plan. An EBHRA may be offered to all employees to cover co-pays, deductibles, premiums for vision or dental insurance, and it may also cover COBRA continuation and some short-term insurance.

Retiree HRA

HSA Solution from FBA

What is an HSA?

An HSA is a Health Savings Account. HSAs are a handy way to save for medical expenses and reduce taxable income. If you are enrolled in a high-deductible health plan (HDHP), you can qualify for an HSA.

Health Savings Account (HSA)

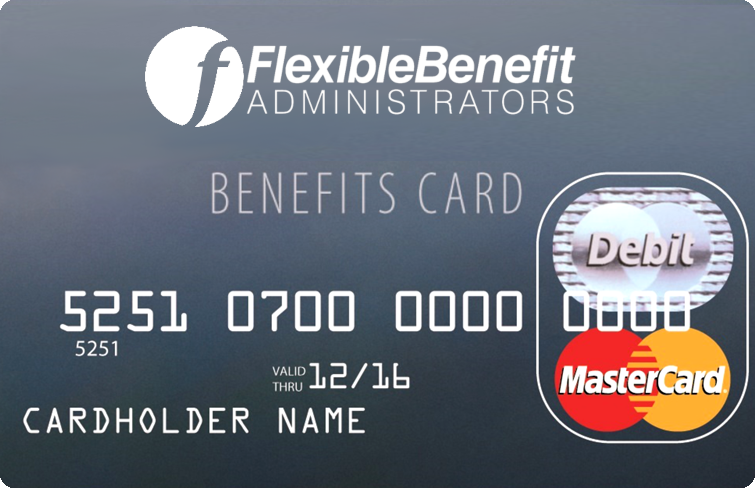

The FBA Benefits Card

The FBA Benefits Card provides your employees with immediate, thought-free access to their funds since one card can access all of your pre-tax benefits. This eliminates confusion for your participants since the card can determine automatically whether an expense is eligible and which bucket of money to pull from based on the merchant.

Why Our Card is Different

Minimal Documentation Requests

Identity Theft Protection

Since our card is issued through MasterCard®, participants are entitled to identity theft and fraud protection at absolutely no cost to you or them. MasterCard® partners with CSID®, an industry leader in identity theft and fraud protection, to help keep participant information safe. Not only will participants receive alerts, but they can also get expert assistance replacing lost items and guidance should they become the victim of identity theft.

Additionally, participants can register various items to be monitored. This includes but is not limited to:

- Social security number

- Credit, debit, and prepaid cards

- Bank accounts

- Driver’s licenses

- Health, dental, and vision cards

- And more!

When a participant is ready to register, they can sign up using their FBA Benefits Card at: mastercardus.idprotectiononline.com

We provide coverage, wherever you are.

FBA was one of the first third-party benefit administrators in the nation, and covers the nation, from coast to coast.

So no matter where you are in the United States, you'll be able enjoy all the advantages of our customized plans, personalized attention, excellent service, flexibility, knowledge and experience.